Fiji Development Bank (FDB) Choice Home Loan

The FDB Choice Home Loan is designed to help Fijians achieve home ownership through affordable, structured, and accessible housing finance. Whether you are purchasing your first home, building, renovating, or refinancing an existing property, the Choice Home Loan provides financing solutions tailored to your needs.

The product is supported by the Reserve Bank of Fiji (RBF) Housing Facility and the Government First Home Buyer Grant Scheme, making home ownership more attainable for low-to – middle income households. With flexible terms, competitive interest rates, and inclusive eligibility criteria, the FDB Choice Home Loan supports individuals and families across urban and rural Fiji.

Loan Features:

- Secured loan term of up to 30 years.

- Available for home purchase, construction, renovations/improvements, and refinance.

- Secured housing loans with registered mortgage.

- Unsecured rural home renovation option available (up to $10,000).

- Equity contribution through Government grant, FNPF, and/or cash for Secured loan

- Interest rates based on approved funding source.

- Household income less than $50,000 @ 3.99% fixed for the first 5 years, and 6% variable per annum thereafter.

- Other secured and unsecured loan @ 6% variable per annum.

- No internal bank fees for the first 6 months for both Secured and Unsecured loans.

Facility Limit:

Secured Loans

-

- Maximum loan amount: $500,000 per borrower

- Up to five times gross income.

- Total advance does not exceed 100% of the Bank’s valuation of the property to be purchased or constructed.

- Maximum loan amount: $500,000 per borrower

Unsecured Loans

- Minimum: $2,500

- Maximum: $10,000

Choice Home Loan Brochures

Frequently Asked Questions (FAQs):

The FDB Choice Home Loan is a housing finance product offered by the Fiji Development Bank to support home ownership. It provides financing for purchasing, building, renovating, or refinancing residential properties, supported by the Fiji Government and Reserve Bank of Fiji Housing Facility.

The Choice Home Loan can be used for:

- Home purchase

- Home construction

- Home renovations or improvements

- Refinancing of existing housing loans

- Rural home renovations (unsecured option for eligible applicants)

Eligible applicants include:

- New clients engaged in salaried employment with verifiable income.

- New clients engaged in earning regular income without formal pay slips are also eligible.

- Existing clients under the Agriculture, MSME, or Commercial sectors with a satisfactory repayment history.

- Applicants must be 18 years or older

- Eligibility extends equally to women, youth (18–35), persons with disabilities, and vulnerable groups, in line with FDB’s GESI Policy

For Secured Loans (General):

- Completed Credit Information Reporting Agency (CIRA) Consent Form.

- Birth Certificate.

- Photo ID – Voter Identification Card/Passport/Driving License/Joint FRCS/FNPF card.

- Current Utility Bills – these would be utility bills for the business/ tenancy agreement.

- Declaration of External Debt: provision of latest loan statement.

- Right of Land Use – Copy of Title

- Title and current lease over land to be used for the proposed project.

- Term of lease must exceed the loan term granted.

- Employment Status: Letter from current employer confirming at least 12 months of continuous confirmed employment.

- Proof of Income

- Payslips, employment contracts, or employer confirmation letters (if applicable).

- Declaration of income (if applicable).

- If owning any business or are self-employed, Notice of Assessment from FRCS for last financial year. (if applicable).

- Equity – Bank statements or FNPF eligibility letter to be produced as evidence of contribution amount.

- Valuation report

- Satisfactory valuation report from FDB’S panel of valuers.

- If FNPF contribution involved, valuation report from FNPF is acceptable.

- Valid Engineers Certificate: from FDB’s panel of engineers (if applicable).

Home Purchase

- All conditions under general requirement.

- Satisfactory confirmation of sale amount (Sale Note or Sale & Purchase Agreement.)

Home Construction / Renovation / Improvements

- All conditions under general requirement.

- Approved building plans & specifications from relevant authorities.

- Quotations:

- At least two quotations from reputable builders/contractors from FDB’s panel,

OR - One quotation with a Bill of Quantity (BoQ) from a qualified surveyor.

For “Purchase of residential lot & construction,” house must be completed within 12 months from the date of land purchase.

- At least two quotations from reputable builders/contractors from FDB’s panel,

- Refinance

1. All conditions under general requirement.

2. Bank statements for the last 6 months confirming transactions and refinance amount.

For Unsecured Loans

- Completed Credit Information Reporting Agency (CIRA) Consent Form

- Birth Certificate

- Photo ID: Voter Identification Card/Passport/Driving License/Joint FRCS/FNPF Card.

- Current utility bills.

- Declaration of external debts – provision of latest loan statement

- Quotations – for material and labor for renovation work.

- Support Letter from Turaga-Ni- Koro- to confirm residence status of the applicant.

- Proof of Income – Payslips, employment contracts, or employer confirmation letters (if applicable)

Credit Assessment: Normal FDB screening and eligibility requirements apply.

Applicants can apply:

- Online: Submit pre-qualification documents through the FDB online portal.

- Traditional/Branch: Submit documents physically at the nearest FDB branch.

All required documents must be complete for the Bank to process the application.

Secured loans

- Registered mortgage project Land and Building

- Mandatory insurance: All Risk Protection. However, in cases where it may bot be practical or possible to get all risk protection, Fire Cover will suffice.

- Optional Insurance: Mortgage Protection cover

- Others as the Bank may require secure the borrowing

Unsecured loans – Nil collateral however assignment over salary proceed will apply.

Loan disbursement to be done to vendors providing service in line with quotations

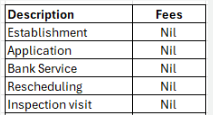

- No internal bank fees for the first 6 months for both secured and unsecured home loans as shown in the table below:

- External costs such as valuation, legal, consent, and insurance fees apply.

- FNPF transfer and consent fees are payable by the applicant.

- All other charges as defined in the Banks Fees and charges brochure will apply.

Call a Branch close to you on (+679) 331 4866 – Find our branches OR email us at info@fdb.com.fj