- Home

- About FDB

- Product

- Small & Medium Business Loans

- Working Capital Loan

- Horticulture, Grains & Pulses Farming

- Livestock Farming

- Root Crops, Ginger, Vegetable & Fruit Farming

- Farm Development Loan

- Purchase of Farm Land

- Farm House Construction Loan

- Farm Land Sub-division Loan

- Farm Vehicles, Machinery, Implements & Equipment Loan

- Fishing Loans

- Sugar Cane Farming

- Broiler – Small Holder Chicken Farm

- Building Construction

- Commercial Property Loan

- Transport – Freight Purposes

- Commercial Loans

- Purchase of New Vehicles, Plant and Equipment

- Bus Loans

- Minibus Loans

- Taxi Loans

- Beef Farming Loans

- Coconut Farming Loans

- Dairy Farming Loans

- Agriculture Family Loan Facility – Grow As A Family

- Yaubula Term Deposit

- Climate & Eco-Finance

- FDB’s COVID-19 Affected Customer Relief Package

- Rice Mobility Package

- Small and Medium Enterprise Sustainability Package

- Ginger Loan Facility – Agriculture Value Chain

- FDB Loan for Women Entrepreneurs

- Sugarcane Farmers Special Loan Facility

- Locations

- Media

- Education & Feedback

- Home

- About FDB

- Product

- Small & Medium Business Loans

- Working Capital Loan

- Horticulture, Grains & Pulses Farming

- Livestock Farming

- Poultry Farming

- Root Crops, Ginger, Vegetable & Fruit Farming

- Farm Development Loan

- Purchase of Farm Land

- Farm House Construction Loan

- Farm Land Sub-division Loan

- Farm Vehicles, Machinery, Implements & Equipment Loan

- Coconut Farming Loans

- Dairy Farming Loans

- Agriculture Family Loan Facility – Grow As A Family

- Yaubula Term Deposit

- Climate & Eco-Finance

- Rice Mobility Package

- Small and Medium Enterprise Sustainability Package

- Ginger Loan Facility – Agriculture Value Chain

- FDB Loan for Women Entrepreneurs

- Sugarcane Farmers Special Loan Facility

- Dairy Farming Loan- Agriculture Value Chain

- Small & Medium Business Loans

- Working Capital Loan

- Horticulture, Grains & Pulses Farming

- Livestock Farming

- Root Crops, Ginger, Vegetable & Fruit Farming

- Farm Development Loan

- Purchase of Farm Land

- Farm House Construction Loan

- Farm Land Sub-division Loan

- Farm Vehicles, Machinery, Implements & Equipment Loan

- Fishing Loans

- Sugar Cane Farming

- Broiler – Small Holder Chicken Farm

- Building Construction

- Commercial Property Loan

- Transport – Freight Purposes

- Commercial Loans

- Purchase of New Vehicles, Plant and Equipment

- Bus Loans

- Minibus Loans

- Taxi Loans

- Beef Farming Loans

- Coconut Farming Loans

- Dairy Farming Loans

- Agriculture Family Loan Facility – Grow As A Family

- Yaubula Term Deposit

- Climate & Eco-Finance

- FDB’s COVID-19 Affected Customer Relief Package

- Rice Mobility Package

- Small and Medium Enterprise Sustainability Package

- Ginger Loan Facility – Agriculture Value Chain

- FDB Loan for Women Entrepreneurs

- Sugarcane Farmers Special Loan Facility

- Locations

- Media

- Education & Feedback

- Home

- About FDB

- Product

- Small & Medium Business Loans

- Working Capital Loan

- Horticulture, Grains & Pulses Farming

- Livestock Farming

- Poultry Farming

- Root Crops, Ginger, Vegetable & Fruit Farming

- Farm Development Loan

- Purchase of Farm Land

- Farm House Construction Loan

- Farm Land Sub-division Loan

- Farm Vehicles, Machinery, Implements & Equipment Loan

- Coconut Farming Loans

- Dairy Farming Loans

- Agriculture Family Loan Facility – Grow As A Family

- Yaubula Term Deposit

- Climate & Eco-Finance

- Rice Mobility Package

- Small and Medium Enterprise Sustainability Package

- Ginger Loan Facility – Agriculture Value Chain

- FDB Loan for Women Entrepreneurs

- Sugarcane Farmers Special Loan Facility

- Dairy Farming Loan- Agriculture Value Chain

- Small & Medium Business Loans

- Working Capital Loan

- Horticulture, Grains & Pulses Farming

- Livestock Farming

- Root Crops, Ginger, Vegetable & Fruit Farming

- Farm Development Loan

- Purchase of Farm Land

- Farm House Construction Loan

- Farm Land Sub-division Loan

- Farm Vehicles, Machinery, Implements & Equipment Loan

- Fishing Loans

- Sugar Cane Farming

- Broiler – Small Holder Chicken Farm

- Building Construction

- Commercial Property Loan

- Transport – Freight Purposes

- Commercial Loans

- Purchase of New Vehicles, Plant and Equipment

- Bus Loans

- Minibus Loans

- Taxi Loans

- Beef Farming Loans

- Coconut Farming Loans

- Dairy Farming Loans

- Agriculture Family Loan Facility – Grow As A Family

- Yaubula Term Deposit

- Climate & Eco-Finance

- FDB’s COVID-19 Affected Customer Relief Package

- Rice Mobility Package

- Small and Medium Enterprise Sustainability Package

- Ginger Loan Facility – Agriculture Value Chain

- FDB Loan for Women Entrepreneurs

- Sugarcane Farmers Special Loan Facility

- Locations

- Media

- Education & Feedback

FDB’s 2019 National SME Awards – Youth Entrepreneur of the Year

FDB’s 2019 National SME Awards – Green SME of the Year

November 4, 2019

Photo Gallery – Winners of the FDB’s 2019 National SME Awards

March 1, 2020FDB’s 2019 National SME Awards

CATEGORY 3: EMPOWERMENT AWARDS

YOUTH ENTREPRENEUR OF THE YEAR

– SPONSORED BY MECHANICAL SERVICES PTE LTD

Youth Entrepreneur of the Year award recognizes innovative youths that carry the principal responsibility for the operations and recent performance of more mature businesses.

ELIGIBILITY AND JUDGING CRITERIA:

To apply for any of the awards in this category, your business should first be able to demonstrate it meets the

eligibility criteria.

Judging criteria includes evidence that demonstrates age of entrepreneur, to be between 18 and 35 years, who owns and operates or who bears principal responsibility for the operations and recent performance of the business for the last five years or more.

Further, the entrepreneur must be able to demonstrate how he/she incorporates innovative traits into business

methods to position its product or service strategically in the marketplace.

The owner must also demonstrate leadership traits by showing evidence of strong financial and business performance skills including sustainable practices that benefits the community and environment.

Types of SMEs that can apply for this award:

Examples of entrepreneurs that can apply for this award includes any person between the ages of 18 and 35 years who:

- Carries the principal responsibility for the operations and recent performance of more mature businesses (5 years or more).

- Could be a business in any sector: agriculture, manufacturing, tourism, professional & business services or wholesale/retail sector.

- An entrepreneur who has strong money management traits and has a healthy savings trend.

- An entrepreneur who has progressed in business through the use of technology in his or her business.

- An entrepreneur who has a strategic advantage for his or her product/service in the market for some time now.

- An entrepreneur who has a comprehensive customer service strategy in his or her business plan.

- An entrepreneur who values team work and his or her employees.

- An entrepreneur who creates a competitive advantage after having found and tested how he or she can perform better than competitors.

- An entrepreneur who is involved, whether online or in your community (or both) to advocate for the environment and the community.

- An entrepreneur who has empowered him or herself and others for example by creating jobs in the community.

- An entrepreneur who has incorporated “Green” business principles in business could be considered for this award too.

- An entrepreneur who has incorporated risk management strategies and treatment plans in business could be considered for this award too.

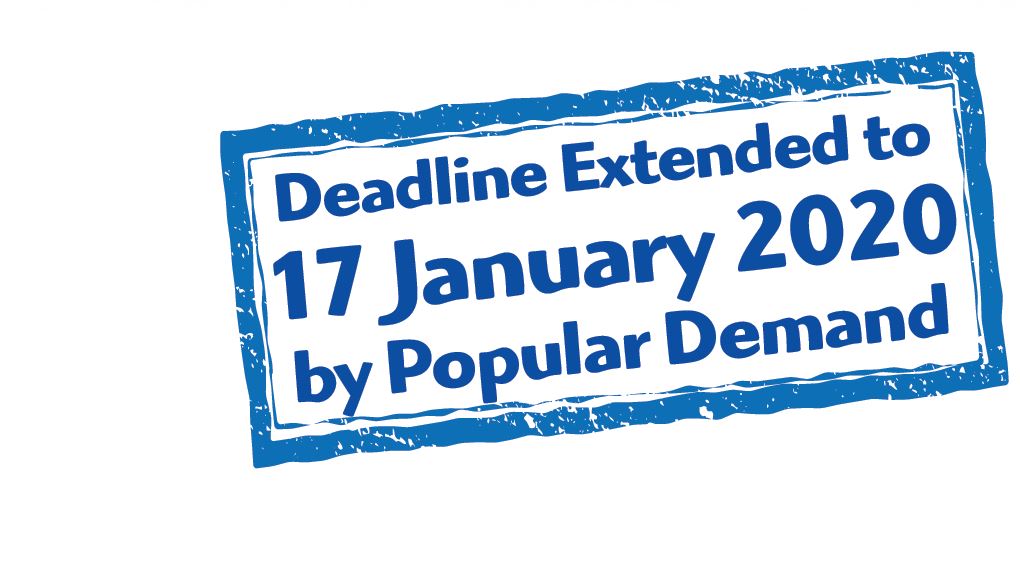

Apply Today! Download the Entry Form