- Home

- About FDB

- Product

- Small & Medium Business Loans

- Working Capital Loan

- Horticulture, Grains & Pulses Farming

- Livestock Farming

- Root Crops, Ginger, Vegetable & Fruit Farming

- Farm Development Loan

- Purchase of Farm Land

- Farm House Construction Loan

- Farm Land Sub-division Loan

- Farm Vehicles, Machinery, Implements & Equipment Loan

- Fishing Loans

- Sugar Cane Farming

- Broiler – Small Holder Chicken Farm

- Building Construction

- Commercial Property Loan

- Transport – Freight Purposes

- Commercial Loans

- Purchase of New Vehicles, Plant and Equipment

- Bus Loans

- Minibus Loans

- Taxi Loans

- Beef Farming Loans

- Coconut Farming Loans

- Dairy Farming Loans

- Agriculture Family Loan Facility – Grow As A Family

- Yaubula Term Deposit

- Climate & Eco-Finance

- FDB’s COVID-19 Affected Customer Relief Package

- Rice Mobility Package

- Small and Medium Enterprise Sustainability Package

- Ginger Loan Facility – Agriculture Value Chain

- FDB Loan for Women Entrepreneurs

- Sugarcane Farmers Special Loan Facility

- Locations

- Media

- Education & Feedback

- Home

- About FDB

- Product

- Small & Medium Business Loans

- Working Capital Loan

- Horticulture, Grains & Pulses Farming

- Livestock Farming

- Poultry Farming

- Root Crops, Ginger, Vegetable & Fruit Farming

- Farm Development Loan

- Purchase of Farm Land

- Farm House Construction Loan

- Farm Land Sub-division Loan

- Farm Vehicles, Machinery, Implements & Equipment Loan

- Coconut Farming Loans

- Dairy Farming Loans

- Agriculture Family Loan Facility – Grow As A Family

- Yaubula Term Deposit

- Climate & Eco-Finance

- Rice Mobility Package

- Small and Medium Enterprise Sustainability Package

- Ginger Loan Facility – Agriculture Value Chain

- FDB Loan for Women Entrepreneurs

- Sugarcane Farmers Special Loan Facility

- Dairy Farming Loan- Agriculture Value Chain

- Small & Medium Business Loans

- Working Capital Loan

- Horticulture, Grains & Pulses Farming

- Livestock Farming

- Root Crops, Ginger, Vegetable & Fruit Farming

- Farm Development Loan

- Purchase of Farm Land

- Farm House Construction Loan

- Farm Land Sub-division Loan

- Farm Vehicles, Machinery, Implements & Equipment Loan

- Fishing Loans

- Sugar Cane Farming

- Broiler – Small Holder Chicken Farm

- Building Construction

- Commercial Property Loan

- Transport – Freight Purposes

- Commercial Loans

- Purchase of New Vehicles, Plant and Equipment

- Bus Loans

- Minibus Loans

- Taxi Loans

- Beef Farming Loans

- Coconut Farming Loans

- Dairy Farming Loans

- Agriculture Family Loan Facility – Grow As A Family

- Yaubula Term Deposit

- Climate & Eco-Finance

- FDB’s COVID-19 Affected Customer Relief Package

- Rice Mobility Package

- Small and Medium Enterprise Sustainability Package

- Ginger Loan Facility – Agriculture Value Chain

- FDB Loan for Women Entrepreneurs

- Sugarcane Farmers Special Loan Facility

- Locations

- Media

- Education & Feedback

- Home

- About FDB

- Product

- Small & Medium Business Loans

- Working Capital Loan

- Horticulture, Grains & Pulses Farming

- Livestock Farming

- Poultry Farming

- Root Crops, Ginger, Vegetable & Fruit Farming

- Farm Development Loan

- Purchase of Farm Land

- Farm House Construction Loan

- Farm Land Sub-division Loan

- Farm Vehicles, Machinery, Implements & Equipment Loan

- Coconut Farming Loans

- Dairy Farming Loans

- Agriculture Family Loan Facility – Grow As A Family

- Yaubula Term Deposit

- Climate & Eco-Finance

- Rice Mobility Package

- Small and Medium Enterprise Sustainability Package

- Ginger Loan Facility – Agriculture Value Chain

- FDB Loan for Women Entrepreneurs

- Sugarcane Farmers Special Loan Facility

- Dairy Farming Loan- Agriculture Value Chain

- Small & Medium Business Loans

- Working Capital Loan

- Horticulture, Grains & Pulses Farming

- Livestock Farming

- Root Crops, Ginger, Vegetable & Fruit Farming

- Farm Development Loan

- Purchase of Farm Land

- Farm House Construction Loan

- Farm Land Sub-division Loan

- Farm Vehicles, Machinery, Implements & Equipment Loan

- Fishing Loans

- Sugar Cane Farming

- Broiler – Small Holder Chicken Farm

- Building Construction

- Commercial Property Loan

- Transport – Freight Purposes

- Commercial Loans

- Purchase of New Vehicles, Plant and Equipment

- Bus Loans

- Minibus Loans

- Taxi Loans

- Beef Farming Loans

- Coconut Farming Loans

- Dairy Farming Loans

- Agriculture Family Loan Facility – Grow As A Family

- Yaubula Term Deposit

- Climate & Eco-Finance

- FDB’s COVID-19 Affected Customer Relief Package

- Rice Mobility Package

- Small and Medium Enterprise Sustainability Package

- Ginger Loan Facility – Agriculture Value Chain

- FDB Loan for Women Entrepreneurs

- Sugarcane Farmers Special Loan Facility

- Locations

- Media

- Education & Feedback

Fiji Development Bank: Breaking Barriers to Agriculture Finance

FDB enhances access to Agriculture Financing through value chain model

February 4, 2022

Fiji Development Bank launches sustainability package for SMEs

February 24, 2022With the vision to be a dynamic financial service provider in the development of Fiji, the Fiji Development Bank (FDB) continues to support Fijians through tailor-targeted financial solutions – which have contributed significantly to improving access to agriculture finance.

Earlier this month, we launched the Agriculture Value Chain Financing (AVCF) facility. For the small to medium-size farmers, this method will offer a mechanism to obtain financing that may otherwise not be available due to a lack of collateral or transaction costs of securing a loan and it can be a way to guarantee a market for products. The advantage of this concept is that it connects farmers to a guaranteed market, allowing them to access financing and technical assistance more readily.

Agriculture Family Loan (AFL) Facility

The absence of a lease can sometimes get in the way of much-needed finance. FDB’s ‘Agriculture Family Loan’ facility breaks the barrier to accessing finance.

FDB has come up with an innovative solution, specifically for farmers who have been farming without a formal lease for 10 years or more.

Some of the features of this facility are as follows. However, there are other requirements in addition to the characteristics below. For full details of the facility as well as the Credit Criteria, please consult a Relationship and Sales Officer at your nearest FDB branch or visit our website www.fdb.com.fj

| Uniqueness of this Product | Characteristics of this facility |

| If you have a viable family farming business on family land, mataqali, or other land usage arrangements with the consent of the owner of the land, then this product is tailor-made for you.

But: You and your family must be involved in growing your family farming business.

|

Mode of Farming: Subsistence Farmer, Semi Commercial, and Commercial farmers.

Type of Farmer: Farmers producing crops or non-cane Farmers, livestock, or crop/livestock (multi-crop) and that are covered under bilateral quarantine agreement such as eggplant, okra, pawpaw, chilies, breadfruit, rice, taro, cassava, fruits, vegetables, kava, organic products, and livestock; Experience – Farmers with 10 years and over farming experience;

Eligible farmers under the AFL facility can easily access loans with interest rates ranging from as low as 4.08% to 9.49% per annum. |

Picture Caption: Grow as a family with the FDB Agriculture Family Loan Facility

Rice Mobility Package

The Package promotes self-sufficiency in the production of agricultural commodities and builds on the path to food security resilience against the backdrop of a post-COVID recovery.

FDB is offering this solution in conjunction with Fiji Rice Limited. The partnership allows Fiji Rice to validate annual yields of farmers seeking access to financing and those with potential for expansion for loan application assessment by the Bank. This removes the burden of providing documentary evidence of production from the shoulders of the farmer. Also, FDB’s end-to-end digital application process adds to the convenience for farmers to be able to submit loan applications conveniently.

Some of the features of this facility are as follows. However, there are other requirements in addition to the characteristics below. For full details of the facility as well as the Credit Criteria, please consult a Relationship and Sales Officer at your nearest FDB branch or visit our website www.fdb.com.fj

| Uniqueness of this Product | Characteristics of this facility |

| Rice farmers that previously lacked access to finance, due to barriers such as the absence of land ownership or a guaranteed market, can now increase their farm efficiency and expand operations.

Product specialty is that farmers are provided with the secured market through Fiji Rice Ltd. |

The Package offers financing to existing and new Fiji Rice Ltd farmers to either start or expand their farming operations and invest in improving efficiency through mechanization to meet the shortages of machinery, equipment, and labor.

This includes those rice farmers who farm on land without a lease or title.

Eligible farmers without any formal lease can easily access loans up to a minimum of $5,000 to $10,000 without any security with as low as a 4.99% interest rate per annum. |

Harvester Financing – Cane and Rice Harvesters

Be it individuals or cooperatives, FDB has a solution for our farmers in terms of assisting them to mechanize their farms through the purchase of farm vehicles, machinery, implements, or equipment. As part of our strategic direction towards mechanization of the small and medium-sized farms, we have assisted farmers with the purchase of cane and rice harvesters.

Mechanical cane harvesters are an advanced technological intervention that was warranted by the industry in response to shortages in labor during harvesting seasons, which in turn affected transportation and consistent supply of canes to mills.

Rice harvesters also solve farmers’ concerns of securing laborers for harvesting – the machine significantly reduces manpower and speeds up the harvesting process.

Some of the features of this facility are as follows. However, there are other requirements in addition to the characteristics below. For full details of the facility as well as the Credit Criteria, please consult a Relationship and Sales Officer at your nearest FDB branch or visit our website www.fdb.com.fj

| Uniqueness of this Product | Characteristics of this facility |

| FDB provides financing for both cane and rice harvesters with terms available to suit the applicant’s business cycle. | Harvester financing is provided through FDB’s Farm Vehicles, Machinery, Implements & Equipment Loan facility.

It is available for cooperatives as well as individuals.

Competitive interest rates as low as 4.08% are offered and normal FDB screening for credit assessment applies. |

Picture Caption: Fiji Development Bank Lautoka branch staff during a visit to customer Hira Swamy Naidu. The Bank assisted him with the financing of the cane harvester and the infielder.

FDB is proud to present various other products as listed below, which customers can take advantage of.

| Sustainable Energy Financing | Agricultural Projects – Horticulture, Grains, Pulses, Livestock, Dairy, and Poultry | Agricultural Projects – Coconut, Dairy, and Beef Farming | Export Credit Facility |

| Small & Medium Enterprise Projects | Agricultural Projects – Agricultural Land Development | Broiler Industry – Small Holder Chicken Farm Projects | MSME Credit Guarantee Scheme |

| Working Capital | Agricultural Projects – Agricultural Land Purchase (for production other than sugar cane) | Building Construction | Agricultural Projects – Loans to Fishermen |

| Facilities Under SCARF – Eco-tourism and Village-based Tourism Projects | Agricultural Projects – Agricultural Land Sub-Division | Purchase of Commercial and Industrial Buildings | Agricultural Projects – Farm Vehicles, Machinery, Equipment and Implements |

| Loans to Sugar Cane Farmers – All Purposes | Agricultural Projects – Construction of Farm Housing on Non-Cane Farmers | Purchase of New Vehicles, Plant and Equipment | Freight Transport |

The above-mentioned products are a summary of financial solutions that we offer to cater to the needs of almost every single farmer in the country. To know more about these products, please call an FDB branch nearest to you or visit our website www.fdb.com.fj or send us an email at info@fdb.com.fj

As per FDB’s ACT, “The functions of the Bank shall be to facilitate and stimulate the promotion and development of natural resources, transportation, and other industries and enterprises in Fiji and, int the discharge of these functions, the Bank shall give special consideration and priority to the economic development of the rural and agricultural sectors of the economy of Fiji.”

In accordance with the ACT above, our core business segment is agriculture and small and medium enterprises (SMEs) and we have found our sweet spot in these two segments.

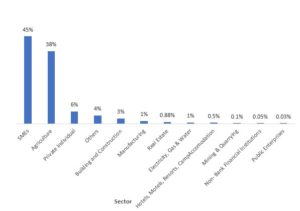

As you can see in the graph below, 83% of our customer base is amongst these two categories.

Getting Closer to our Customers

A critical part of our success formula is engaging with our customers. We strongly believe that customer support is the route to customer success. Therefore, we remain in constant contact with them – because we care about our customers succeeding in their venture.

Apart from assisting the farmers with ease of access to financial solutions, our staff have been actively involved in financial education and awareness. Through our Financial Literacy Programme, we have been empowering farmers and small to medium-size entrepreneurs to make informed financial decisions. Our officers have been visiting villages and meeting with the farmers – educating them about how they can start or expand their farm operations during this crisis. Our officers also conduct routine assessments to ensure the customers are provided with whatever advice that they may require.

Changing the way we do Banking

Digitalization is changing how people interact and do business on a day-to-day basis, and advancements in banking technology are continuing to influence the future of financial services around the world. Here at FDB, we are also continuing our efforts to enhance our services in meeting the needs of our customers through various digital platforms.

We offer our customers various means of accessing their accounts to check their account details, view statements through the online client statement portal, and carry out loan repayments through various digital platforms such as MPaisa, internet banking, and MyCash.

We are moving away from the brick-and-mortar way of Banking. Our emphasis now is more on web-based operations. This has allowed access to our products and services to the remote areas of Fiji while creating a win-win opportunity for both our customers and the Bank – with the same number of people we can reach out to more customers and in the process eliminate any fraud and decrease the turn-around time for a decision. Thus, our customers can receive feedback on their applications promptly.

Bank with us for all your agriculture financing needs and help Fiji meet the national objectives of food security and self-reliance.