- Home

- About FDB

- Product

- Small & Medium Business Loans

- Working Capital Loan

- Horticulture, Grains & Pulses Farming

- Livestock Farming

- Root Crops, Ginger, Vegetable & Fruit Farming

- Farm Development Loan

- Purchase of Farm Land

- Farm House Construction Loan

- Farm Land Sub-division Loan

- Farm Vehicles, Machinery, Implements & Equipment Loan

- Fishing Loans

- Sugar Cane Farming

- Broiler – Small Holder Chicken Farm

- Building Construction

- Commercial Property Loan

- Transport – Freight Purposes

- Commercial Loans

- Purchase of New Vehicles, Plant and Equipment

- Bus Loans

- Minibus Loans

- Taxi Loans

- Beef Farming Loans

- Coconut Farming Loans

- Dairy Farming Loans

- Agriculture Family Loan Facility – Grow As A Family

- Yaubula Term Deposit

- Climate & Eco-Finance

- FDB’s COVID-19 Affected Customer Relief Package

- Rice Mobility Package

- Small and Medium Enterprise Sustainability Package

- Ginger Loan Facility – Agriculture Value Chain

- FDB Loan for Women Entrepreneurs

- Sugarcane Farmers Special Loan Facility

- Locations

- Media

- Education & Feedback

- Home

- About FDB

- Product

- Small & Medium Business Loans

- Working Capital Loan

- Horticulture, Grains & Pulses Farming

- Livestock Farming

- Poultry Farming

- Root Crops, Ginger, Vegetable & Fruit Farming

- Farm Development Loan

- Purchase of Farm Land

- Farm House Construction Loan

- Farm Land Sub-division Loan

- Farm Vehicles, Machinery, Implements & Equipment Loan

- Coconut Farming Loans

- Dairy Farming Loans

- Agriculture Family Loan Facility – Grow As A Family

- Yaubula Term Deposit

- Climate & Eco-Finance

- Rice Mobility Package

- Small and Medium Enterprise Sustainability Package

- Ginger Loan Facility – Agriculture Value Chain

- FDB Loan for Women Entrepreneurs

- Sugarcane Farmers Special Loan Facility

- Dairy Farming Loan- Agriculture Value Chain

- Small & Medium Business Loans

- Working Capital Loan

- Horticulture, Grains & Pulses Farming

- Livestock Farming

- Root Crops, Ginger, Vegetable & Fruit Farming

- Farm Development Loan

- Purchase of Farm Land

- Farm House Construction Loan

- Farm Land Sub-division Loan

- Farm Vehicles, Machinery, Implements & Equipment Loan

- Fishing Loans

- Sugar Cane Farming

- Broiler – Small Holder Chicken Farm

- Building Construction

- Commercial Property Loan

- Transport – Freight Purposes

- Commercial Loans

- Purchase of New Vehicles, Plant and Equipment

- Bus Loans

- Minibus Loans

- Taxi Loans

- Beef Farming Loans

- Coconut Farming Loans

- Dairy Farming Loans

- Agriculture Family Loan Facility – Grow As A Family

- Yaubula Term Deposit

- Climate & Eco-Finance

- FDB’s COVID-19 Affected Customer Relief Package

- Rice Mobility Package

- Small and Medium Enterprise Sustainability Package

- Ginger Loan Facility – Agriculture Value Chain

- FDB Loan for Women Entrepreneurs

- Sugarcane Farmers Special Loan Facility

- Locations

- Media

- Education & Feedback

- Home

- About FDB

- Product

- Small & Medium Business Loans

- Working Capital Loan

- Horticulture, Grains & Pulses Farming

- Livestock Farming

- Poultry Farming

- Root Crops, Ginger, Vegetable & Fruit Farming

- Farm Development Loan

- Purchase of Farm Land

- Farm House Construction Loan

- Farm Land Sub-division Loan

- Farm Vehicles, Machinery, Implements & Equipment Loan

- Coconut Farming Loans

- Dairy Farming Loans

- Agriculture Family Loan Facility – Grow As A Family

- Yaubula Term Deposit

- Climate & Eco-Finance

- Rice Mobility Package

- Small and Medium Enterprise Sustainability Package

- Ginger Loan Facility – Agriculture Value Chain

- FDB Loan for Women Entrepreneurs

- Sugarcane Farmers Special Loan Facility

- Dairy Farming Loan- Agriculture Value Chain

- Small & Medium Business Loans

- Working Capital Loan

- Horticulture, Grains & Pulses Farming

- Livestock Farming

- Root Crops, Ginger, Vegetable & Fruit Farming

- Farm Development Loan

- Purchase of Farm Land

- Farm House Construction Loan

- Farm Land Sub-division Loan

- Farm Vehicles, Machinery, Implements & Equipment Loan

- Fishing Loans

- Sugar Cane Farming

- Broiler – Small Holder Chicken Farm

- Building Construction

- Commercial Property Loan

- Transport – Freight Purposes

- Commercial Loans

- Purchase of New Vehicles, Plant and Equipment

- Bus Loans

- Minibus Loans

- Taxi Loans

- Beef Farming Loans

- Coconut Farming Loans

- Dairy Farming Loans

- Agriculture Family Loan Facility – Grow As A Family

- Yaubula Term Deposit

- Climate & Eco-Finance

- FDB’s COVID-19 Affected Customer Relief Package

- Rice Mobility Package

- Small and Medium Enterprise Sustainability Package

- Ginger Loan Facility – Agriculture Value Chain

- FDB Loan for Women Entrepreneurs

- Sugarcane Farmers Special Loan Facility

- Locations

- Media

- Education & Feedback

FDB’s 2019 National SME Awards – Rookie Youth Entrepreneur of the Year

FDB’s 2019 National SME Awards – Green SME of the Year

November 4, 2019

Photo Gallery – Winners of the FDB’s 2019 National SME Awards

March 1, 2020FDB’s 2019 National SME Awards

CATEGORY 3: EMPOWERMENT AWARDS

ROOKIE YOUTH ENTREPRENEUR OF THE YEAR

– SPONSORED BY FIJI NATIONAL UNIVERSITY

Rookie Youth Entrepreneur of the Year award recognizes budding youth entrepreneurs.

ELIGIBILITY AND JUDGING CRITERIA:

To apply for any of the awards in this category, your business should first be able to demonstrate it meets the

eligibility criteria.

Judging criteria includes evidence that demonstrates age of entrepreneur, to be between 18 and 35 years, who

owns and operates or who bears principal responsibility for the operations and the recent performance of the

business that is a startup.

Further, the entrepreneur must be able to demonstrate these characteristic: produce for a market, have a sound

business plan, use of technology/distribution channels, marketing strategies. The owner must also demonstrate leadership traits by showing evidence of good management skills including sustainable practices that benefits the community and environment.

Types of SMEs that can apply for this award:

Examples of entrepreneurs that can apply for this award includes any person between the ages of 18 and 35 years who:

- Has just started a business that is classified as a SME.

- Could be a business in any sector: agriculture, manufacturing, tourism, professional & business services or wholesale/retail sector.

- An entrepreneur who is able to show basic money management understanding and/or skills.

- An entrepreneur who has introduced use of technology in his or her business.

- An entrepreneur who started with a unique business idea to deliver a service/good for the market. That is, they started a business because there was a demand for it in the market.

- An entrepreneur who makes effort to understand the customer’s needs.

- An entrepreneur who works as a team work with his or her employees, if any.

- An entrepreneur who makes an effort to create a competitive advantage – If you think you don’t have any competition, you’re wrong. All businesses have competition. The question is, what do you do better than your competition? Have you asked yourself this question? Then you are eligible to apply for this award.

- An entrepreneur who has started to involve him or herself, whether online or in your community (or both), to advocate for the environment and the community.

- An entrepreneur who envisions to empowers him or herself and others for example by creating jobs.

- An entrepreneur who has introduced some “Green” business principles into business could be considered for this award too.

- An entrepreneur who has attempted to incorporate risk identification and treatment strategies in business could be considered for this award too.

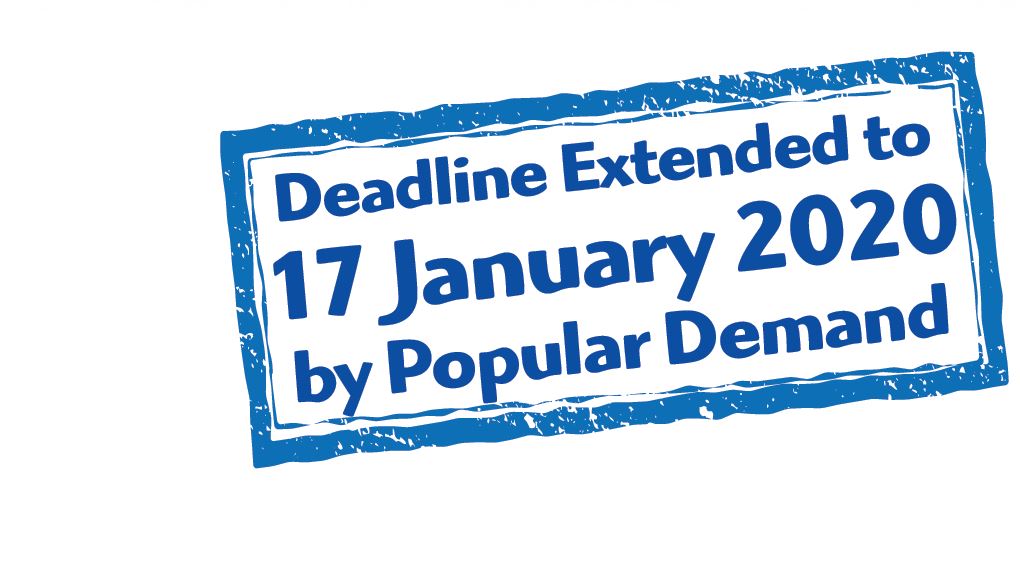

Apply Today! Download the Entry Form